This blog post is part of a series called Why Transparency Matters. Read all posts in this series here.

For several months we have been working on a transparency model, with the aim of releasing a transparency report that breaks prices down beyond FOB, and be clear about our own costs and margins. Our goal is to have this price breakdown a standard part of the information we provide for every coffee we sell, and price transparency data as part of our invoice to our customers.

As we are digging into where value is added in the supply chain, and designing charts and tables for prices paid to smallholders, farmers, washing stations and exporters, we realise that the pricing is only useful when put in to context. It all depends on where and how the value is added and risk is taken.

For now there are many questions, like:

- Why FOB matters, and what does it tell us?

- Farm gate, what does that actually mean?

- Where is the value added, and who is taking the cost and risk?

- And how to compare apples to apples when some farmers sell cherries and others a finished exportable product.

Where we began

When I started Nordic Approach in 2011, nobody published their price list online. Offer lists were mainly PDFs sent out weekly, at best. Us putting everything out there from the beginning, with prices and all information, was seen by many as a revolution. We were also accused by other importers of being opportunistic and disrupting the industry. In addition to posting all our prices on the web, we initially had a fixed pricing structure that made it possible to always work your way backwards to the FOB price, and we gladly shared what we had with our clients, which included our buying contracts.

Yet, I truly believe that as an industry we have to take it further. So why haven’t we? As simple as it may seem, systematic reporting for 100% of our coffees and sales is something that requires a lot of thought, system development and data input. Yet, we aim at getting there in the next few months.

What we want to achieve with transparent price information

The main goal is to be able to pay enough for good coffees so that the farmers can be sustainable, have a decent income and invest to produce quality when and where it makes sense. That said it is not supposed to be aid, and not everyone should be a coffee grower.

For us it is about working at community levels with reasonable premiums to hundreds or even thousands of farmers that make the mark, rather than have a handful of farmers winning the lottery.

If we want to secure our supply of this coffee, we have to pay premiums for quality that get coffee producers above the poverty line and incentivise them to invest and see potential in producing quality coffee.

FOB: what does it mean, and is it important?

FOB means Free on Board, and refers to the price of the export ready coffee from port. It is the price we pay to exporters for the coffee we buy. It is not the price the farmer earned.

Even in the most direct relationships, ownership of the coffee has most likely changed hands several times. A lot of risk is taken, and cost and value are added after processing and drying at the farm or washing station. For example, transport, warehousing, finance, dry milling, grading, bagging/packaging, taxes, and documentation etc. might all be included.

So the FOB price doesn’t tell us what the farmer/producer was paid, or what they delivered. It gives no indication of the supply chain, or who within the supply chain is making money. However we do know there is some correlation between the quality of a coffee and FOB prices. The FOB price doesn’t answer all our questions, but it is a good first step towards creating a different pricing system for specialty coffee. Even if we like to think that the specialty coffee trade is not affected by the C – market, because we buy coffee outright at fixed prices, it’s not really how it works.

Reporting beyond FOB

So here we are, agreeing that transparency on FOB prices can be a good thing! But, as mentioned in the intro, we would eventually like to break it down to a level where the players in the market, and even the consumers, understand that there are many people involved, and each origin has a different supply chain structure where cost, investment and value is added at different stages.

There are already roasters and importers publishing FOB plus the price paid to farmers and producers. And that’s great. But for those who are not too familiar with the details of the supply chain in each origin, it’s sometimes difficult to understand.

Before we continue I will clarify my use of language here:

- A farmer is someone who grows coffee and sells cherries.

- A farmer/producer is someone who grows and processes coffee, meaning they pulp, ferment, and dry the coffee, then sell it as parchment.

- A farmer/producer/exporter is someone who manages the full supply chain at origin and sells green coffee.

Farm gate price = apples and oranges

Farm gate price is a term widely used to state what the farmer was paid, but there are many variables here.

Some farmers grow and harvest cherries, and deliver these to a washing station. This is a common model in Africa. Others are farmer/producers. They grow and harvest the cherries, then they process and dry them on their farm, and deliver parchment to the bodega (buying point) of a farmer association, coop or exporter. This work requires more time, a greater investment in processing facilities, and the farmers take on more risk that the coffee will spoil in the process. Then there are farmer/producer/exporters who have export companies so they are delivering green to the port. You can not compare the prices paid to these different farmers. If you’re not clarifying at what stage the product is sold, it’s comparing apples to oranges.

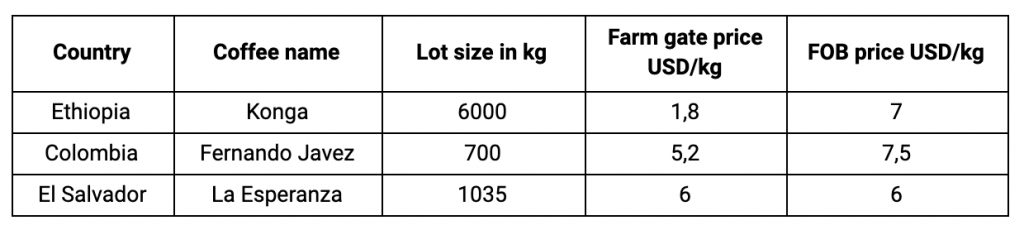

For example (names and prices are fictitious)…

If we take the example table above it may seem like the producer in Ethiopia is suffering the most, while the farmer in El Salvador is earning a much higher income.

There are a number of things to consider including when the transaction occurred and where the cost and value were added. With some additional information to give context, our assumptions change.

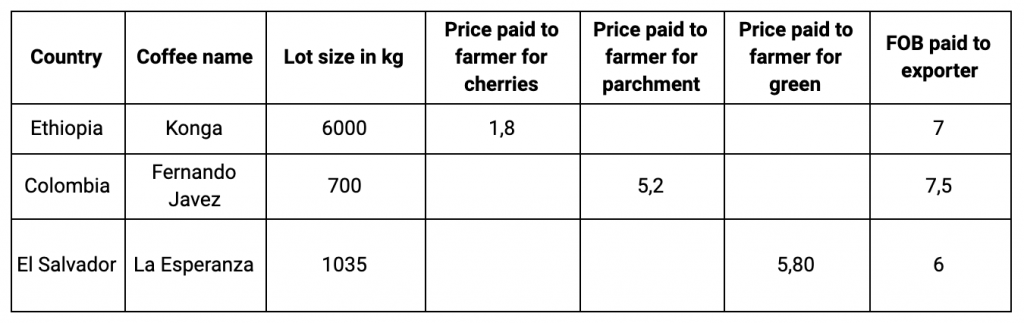

Even with this additional information however, putting the price paid to the farmer in a single column is misleading.

I have also noticed transparency reports that state the FOB price and farm gate price (price paid to the farmer) is the same when they buy from a farmer/producer/exporter. We do understand that it looks better if we/you as a player in the market can say that you paid X amount of money FOB and it all went to the farmer. However unless you have a very good overview of their business, this is rarely true. In most cases each company will be a different legal entity, possibly with multiple stakeholders. Even if in theory it’s the same owner, there are usually multiple stakeholders. Plus there will be direct cost related to the export itself.

To tackle these issues we are working with tables like this one below. Using this format we can compare apples to apples (or cherries to cherries), and show where the farmer entered the supply chain.

Understanding where value is added

To understand the price paid to a farmer, and decide whether or not is fair, we need so much more information. Our long term mission is to create a model, in collaboration with third party organisations, for a more detailed reporting concept based on verified cost of production and cost of living data. We aim to measure our impact not only to an individual farmer, but on a farming community, region and country.

For now we can all start by taking the time to understand the supply chains for each origin, and digging into where value is added and risk is taken. This is essential context for presenting and understanding farm gate prices.

Personalised Transparency Reports

We currently offer a personalised transparency report for roasters which gives the exact breakdown of costs from FOB to the price you paid for any coffee you purchased from Nordic Approach, including our margin.

If you buy coffee from us, you can sign The Pledge. This personalised transparency report includes the information you need to meet the transparency goals of this initiative. Contact your sales rep to request your report.

Nordic Approach 2019 transparency report

We are currently working on detailed transparency reports which breakdown the FOB prices. The first report will be published by the end of the year. Our goal is to include the farm gate price, the FOB, and the costs and value added in between. In future years we will work towards providing cost of production and cost of living context for this data.

Why transparency matters – blog series

This post is part of a series of blog posts called Why Transparency Matters. Beyond a number to publish on our websites or packaging, we are exploring the ways we can all use this information to transform the coffee market to be more sustainable and fair. Read the entire series here.

Have thoughts or questions?

We are very interested in conversations about transparency, and how it should be used to create a sustainable coffee industry. Email suzie@nordicapproach.no to share your ideas.

0 Comments