There is no such thing as business as usual in Ethiopia. Every season has its unique set of challenges, but this year has been a little crazier than usual, even before Covid-19 hit. At the beginning of the season cherry prices were almost double those of last year. Then in mid-season, the industry was hit with a new minimum price directive that threw contracts into disarray. On a positive note, new and exciting coffee profiles that were previously lost into regional blends are now available as fully traceable coffees from small municipalities.

There is a lot to catch up on, so here is a bumper blog post with everything you need to know to plan your Ethiopia buying this year.

Coffees from smaller regions and municipalities

It is an exciting time to be a buyer in Ethiopia. The ECX relaxed their regulations three years ago and the resulting traceability has made it possible for smaller and new regions to sell their coffee as differentiated profiles.

Traditionally the Ethiopian coffee sector has been focused on well known regions like Yirgacheffe, Sidamo and Guji. In the last few years we have seen more municipality coffees on the market, traceable to station, sometimes to the farmer. For example, within Yirgacheffe there is Gedeb, and in Gedeb there is Worka, a small village producing fantastic coffees.

Uraga is another great example. Previously coffee from this area would go into a Guji regional blend. Now you can buy this characteristic coffee from a specific washing station. Occasionally floral and citric, Uraga is mostly recognisable for its papaya, melon and mango profile with high acidity and intensity.

West Arsi is another example, close to Bale Mountain National Park, has very high altitude farms up to 2600 metres. They produce some truly unique Ethiopian coffees that were previously blended and sold as Sidamo.

Hambela Wamena is the new Yirgacheffe. It is a relatively new area for coffee with new trees, very fertile soil and slow maturation. Here we’re finding the notes we’ve been missing in Yirgacheffe coffees in recent years, like bergamot, black tea and jasmine.

Nensebo is located near the national park of Bale Mountain, and though it has existed for quite some time, we are seeing very interesting new profiles with notes of blackcurrant, blueberries and candied plums with a touch of violet. This profile is similar to an SL28 from Kenya.

The popularity of coffees from these smaller zones has led to more investment, new washing stations and better options for farmers. Additionally exporters are on the hunt to find new areas and expand the classic coffee belt, looking to the west and east. Expect even more zones and profiles in the coming years.

Navigating Ethiopian profiles

Before the regulatory changes three years ago, the ECX categorised coffees by regions and this system still dominates. Each region would have its own profile: Yirgacheffe was intensely jasmine and bergamot driven, Guji was stone fruit driven, Sidamo had high acidity and occasional herbal notes, while Limu would be stone fruit, orange citrus and chamomile driven. This old ECX system shunted coffees into limiting categories that were unhelpful for buyers and roasters alike.

We have long felt this system was not up to the task of capturing the broad and complex flavour potential of Ethiopia, so we developed this flavour wheel. Rather than rely on the ECX regional profiles, our Head of Buying and Procurement, Joanne Berry, created this guide to Ethiopian profiles. Our Ethiopian offers have these titles in the lot names to help you know what profile to expect.

What impacts the cup profile of a coffee? Find out more on in this blog post from our sister company, Tropiq.

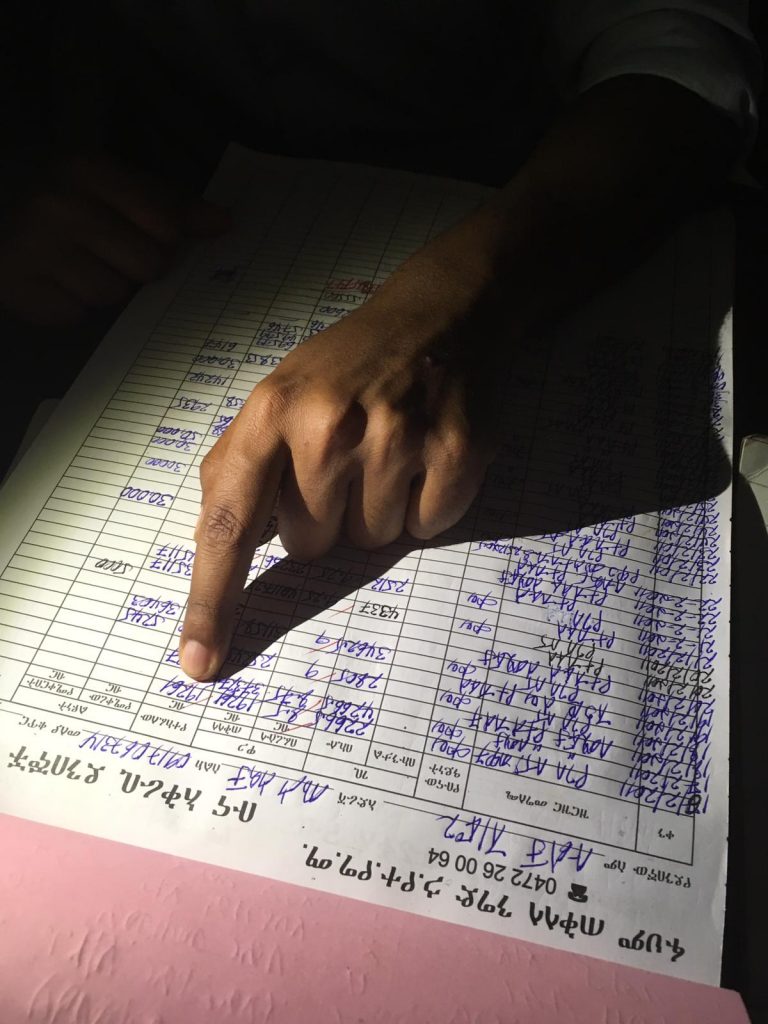

New minimum price directive

Part way through the season this year the Ethiopian government announced a new directive to set a minimum price for coffee. This is part of broad economic reforms intended to curb the practice of selling agricultural products on the international market at a loss, simply to raise foreign currency.

The directive is called the “Export Coffee Contract Administration” and it states that exporters must report the volume and quality (grade) of all deals, within 24 hours of confirming negotiations. Once the contract is concluded, the exporter must deposit the value of the merchandise in the National Bank. The merchandise is then expected to ship out within ninety days.

Failure to comply with the directive could result in a complete ban on conducting business along with criminal charges for the owners.

How does the minimum price directive affect the industry? Farmers are no better off as the directive is not intended to put more money in their pockets. Buyers of Ethiopian coffees at origin must make decisions and move quickly. The minimum price is set daily so it is hard to predict what the daily price will be in the future. Find out more about the minimum price directive in this blog post from our sister company, Tropiq.

Impact of Covid-19

Ethiopia is currently in a state of emergency with strict restrictions on movement of ordinary citizens within the country. However the coffee industry continues to function, albeit a little more slowly as companies make adjustments to keep their staff safe.

Even though we are able to move the coffees, things are a little slower. It is increasingly harder to source containers, and also trucks. Drivers are hesitant to make the trip to Djibouti which means crossing an international border, for fear of infection, or finding themselves stuck on the other side. Internationally ports have been operating below full capacity due to staff shortages, travel restrictions and quarantine measures. Containers that didn’t ship due to the virus outbreak have created a backlog for future shipments so there is some issues accessing containers.

At this point, it is hard to predict when life and business will return to normal, we will keep you updated of any changes.

Planning your Ethiopia buying this year

With the current uncertainty it can be really hard to make business decisions. We have been efficient (and a bit lucky) and we have Ethiopian coffees on the water already or about to ship, but we have reduced our volumes and we are not planning any further containers. We know many roasters who previously bought bigger quantities direct from origin are switching to Spot to have more flexibility. If you are looking for bigger volumes of 100 bags or more, especially if you are seeking a specific profile, you should reserve your coffees now. We offer discounts for volume purchases. If you are looking for smaller volumes and you have more flexibility on the profile, rest assured we will have Ethiopians arriving in the next few months.

0 Comments