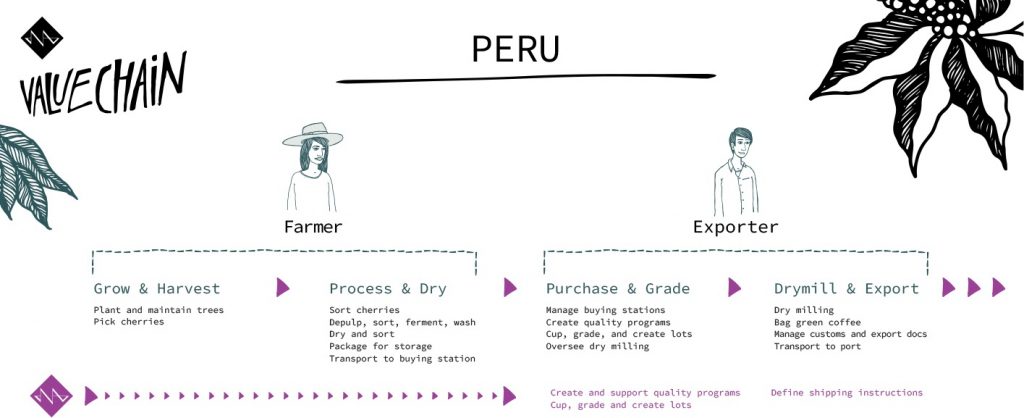

Before diving into any of our transparency data from origin, we ask that you take the time to understand the supply chain in that origin, and specifically, what the farmer delivered, be it cherry, parchment or green.

There are many steps involved to transform coffee cherries to green coffee, bagged and ready to export. Each of these steps is essential meaning none of these steps can be skipped. To simplify the value chain, those steps are:

- Cultivating and picking the coffee;

- Processing, using washed, honey, natural or special processes, then drying to transform cherry to parchment;

- Cupping and grading the coffee to ascertain its quality and price;

- Finding a buyer for the coffee;

- Dry milling to transform parchment to green coffee;

- Bagging the coffee;

- Paying taxes, preparing export documents, transporting the coffee to the port.

Investment + Risk = Price Paid

Who performs each of these steps is different from origin to origin. Prices paid to each player in the value chain depend on the risk and investment they have made. The higher the investment and the greater the risk they carry, the higher the price paid for the coffee.

Cultivation and harvesting

Cultivating coffee requires an investment in land and trees, and the time and labour to tend to the trees and soil. Harvesting requires an investment in time, and sometimes in additional labour to ensure the coffee is picked when it is ripe. Coffee farming carries the risk of inclement weather, disease and pests impacting flowering, fruit production, drying and therefore quality.

Processing and drying

Processing the coffee requires investment in land, infrastructure and time. It carries the risk that the coffee spoils during this process, meaning quality and therefore money could be lost.

Cupping, grading, buying and storing

Cupping, grading, buying and storing the coffee requires an investment in staff, lab facilities and a warehouse space. It carries the risk of the coffee spoiling, meaning quality and therefore money could be lost. There is also a risk that the coffee purchased isn’t sold in a short period of time.

Milling, bagging and transporting

Milling and preparing coffee for export requires investment in a dry mill, or funds to pay for third party dry milling. It requires investment in staff and time to prepare the export documentation and cover the cost of transport and taxes. It carries the risk of the coffee spoiling, meaning quality and therefore money could be lost.

What the farmer earns depends on what they deliver

In order to understand the price paid to the farmer, it is imperative to understand their investment and their risk. Farmers in Africa generally deliver cherries. They are paid a smaller percentage of the FOB than farmers in Latin America who generally deliver parchment.

Why we’re pursuing transparency

Nordic Approach has always pursued transparency in coffee pricing data. In this, our first transparency report from origin, we begin with the FOB price and work our way back, digging into the value chain to show how money is distributed amongst the various players. In future years we will work towards providing cost of production and cost of living context for this data.

Our goal in pursuing transparency is to secure a supply of high quality coffee. In order to achieve this we have to pay premiums for quality that get coffee producers above the poverty line and incentivise them to invest in their production. Transparency will not solve this issue on its own, but it is a step towards creating a sustainable market place for quality coffee. For this we need an independent pricing mechanism so specialty coffee can break free of the C-Price.

Transparency is not a beauty contest or a competition between the players in the already well-established specialty industry. It is a guideline. It should help us understand the difference between specialty and commercial pricing. It should demonstrate if the producer of a coffee you buy was paid above the minimum commercial price within their market. There are many examples where commercial coffees are bought at unsustainably low prices and sold and marketed as specialty coffee. This creates a lot of confusion, both within the industry and among consumers. Even if you have the best of intentions it can be hard to know if you’re doing the right thing.

You can rest assured that if you buy coffee from Nordic Approach, we are doing everything we can to ensure the farmers get paid well above the commercial price. We don’t offer a few standout coffees we can use as examples of high prices, while paying commercial prices for our main volumes. Rather we strive to improve farmer incomes for every lot of coffee we buy.

We work mainly with smallholders, thousands of them. In these communities even small premiums can change lives, and working with smallholders means these benefits are spread across entire communities, not just one or two producers.

We all know we can do better. We need to pay more in order to create a sustainable industry, to provide farmers a dignified life and a future for their families. Transparency data is a first step to understanding what the prices are now, and creating the prices for the future so we can all sustain our businesses and ensure the future of our industry.

We also provide personalised transparency reports for all our roasters to shed light on the value that Nordic Approach adds between the FOB cost and the sale price. Don’t have a personalised transparency report yet? Ask your sales person and we’ll prepare one for your roastery.