Why we’re pursuing transparency

Nordic Approach has always pursued transparency in coffee pricing data. In this, our first transparency overview from origin, we begin with the FOB price and work our way back, digging into the value chain to show how money is distributed amongst the various players. In future years we will work towards providing cost of production and cost of living context for this data.

Our goal in pursuing transparency is to secure a supply of high quality coffee. In order to achieve this we have to pay premiums for quality that get coffee producers above the poverty line and incentivise them to invest in their production. Transparency will not solve this issue on its own, but it is a step towards creating a sustainable market place for quality coffee. For this we need an independent pricing mechanism so specialty coffee can break free of the C-Price.

Transparency is not a beauty contest or a competition between the players in the already well-established specialty industry. It is a guideline. It should help us understand the difference between specialty and commercial pricing. It should demonstrate if the producer of a coffee you buy was paid above the minimum commercial price within their market. There are many examples where commercial coffees are bought at unsustainably low prices and sold and marketed as specialty coffee. This creates a lot of confusion, both within the industry and among consumers. Even if you have the best of intentions it can be hard to know if you’re doing the right thing.

You can rest assured that if you buy coffee from Nordic Approach, we are doing everything we can to ensure the farmers get paid well above the commercial price. We don’t offer a few standout coffees we can use as examples of high prices, while paying commercial prices for our main volumes. Rather we strive to improve farmer incomes for every lot of coffee we buy.

We work mainly with smallholders, thousands of them. In these communities even small premiums can change lives, and working with smallholders means these benefits are spread across entire communities, not just one or two producers.

We all know we can do better. We need to pay more in order to create a sustainable industry, to provide farmers a dignified life and a future for their families. Transparency data is a first step to understanding what the prices are now, and creating the prices for the future so we can all sustain our businesses and ensure the future of our industry.

We also provide personalised transparency reports for all our roasters to shed light on the value that Nordic Approach adds between the FOB cost and the sale price. Don’t have a personalised transparency report yet? Ask your sales person and we’ll prepare one for your roastery.

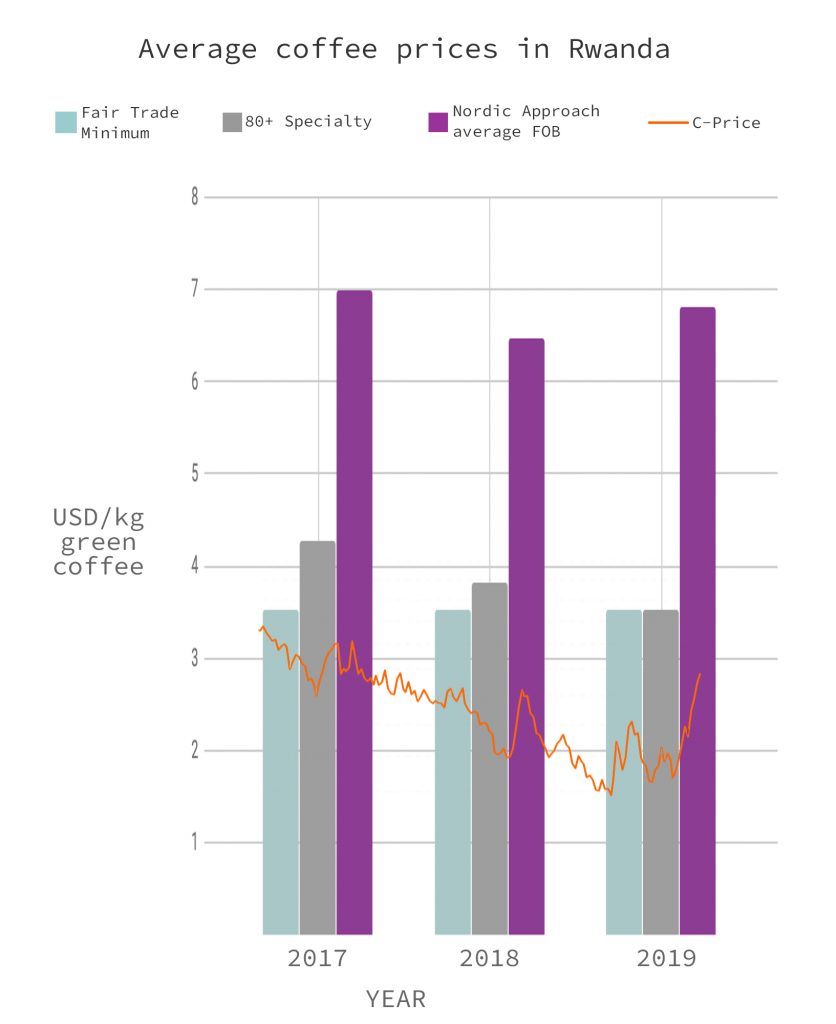

Our Average FOB prices

This stands for “Free on Board” and when expressed as a price in our transparency reports, it means the price we paid to our export partners for that particular lot of coffee. As the chart below demonstrates, the FOB prices we pay in Rwanda are both consistent, and significantly higher than the local market for high quality coffee.

Going beyond FOB

In this, our first transparency overview of an origin value chain, we are going further than FOB. Here we dig into the supply chain to show how that money is distributed within the value chain. Read below to learn about how the coffee industry works in Rwanda, and how we work to deliver the highest possible prices to farmers within the constraints and capacities of the value chain.

How we work in Rwanda

In summary

- We pre-contract the coffees months before the harvest, specifying different preparations and qualities we require.

- Pre-contracting allows our exporter to pre-finance the producer with working capital for cherry purchase and cost of production.

- Through the consistent premiums paid to the washing stations, they have invested in infrastructure for increased quality and incentives to smallholder.

- Beside premiums paid for cherries, the washing stations have local sustainability projects within their outgrower communities.

In detail

Our sourcing in Rwanda is based on some very solid relationships. Our export partner is Rwanda Trading Company (RTC), and through them we buy from Gitesi Washing Station and the RTC-financed Mahembe Washing Station. We began buying in Rwanda in 2012 and our partners include Aime and Alexis Gahizi, a father-son team who own and manage the Gitesi Washing Station, and Justin Musabyiama, owner of the Mahembe Washing Station and a farmer with an 8 hectare plot of land. We occasionally buy from other washing stations through RTC when volumes can’t be met by Mahembe or Gitesi, but these two producers are our primary portal to the smallholder farmers in their communities.

We work with smallholders in Rwanda because this is where we see we can make the greatest impact. We believe many of the world’s best coffees come from smallholders, and if we want to offer them a future in coffee, and incentivise them to invest in this crop, we need to pay stable premiums for quality. Over 60% of farmers in Rwanda process coffees on their farm with minimal and very rustic infrastructure. That means they pick, pulp and dry the beans on the ground. They sell this coffee to local middlemen who in turn sell it as non-traceable cheap commercial coffee.

Farmers who deliver cherry to Gitesi or Mahembe washing stations are paid a premium for selectively picked ripe cherries. We contract these coffees very early in the season which means RTC can pre-finance the washing stations at the beginning of the harvest. This finance is working capital for the washing stations, enabling them to buy cherries and manage the post-harvest processing. This leads to a more consistent income for smallholder coffee growers.

Additionally, our partners offer education programs for their farmers to help them increase yield and improve quality, which means higher premiums for future harvests. Mahembe offer an agricultural extension program run by RTC. Gitesi offer an extensive education programme covering a wide range of topics from farm management to financial literacy and civic responsibility, plus they have a very successful cow distribution project. Low-income farmers are given a cow to give them an additional income stream and improve the family’s nutrition. If the cow produces a calf, it must be passed on to another farmer in need.

While we have no problem finding great quality coffee, there is an oversupply of lower priced Rwandans in the market. We often struggle to sell bigger volumes of higher quality coffees at the premiums we pay. This is something we are working to change by diversifying our inventory with a selection of lower priced Peaberry lots (still at higher premiums to the farmer) and natural processed lots.

What you need to know about the coffee value chain

In order to have the correct context for the price data published here, we ask that you take the time to understand the supply chain in each origin.

There are many steps involved to transform coffee cherries to green coffee, bagged and ready to export. Each of these steps is essential meaning none of these steps can be skipped. To simplify the value chain, those steps are:

- Cultivating and picking the coffee;

- Processing, using washed, honey, natural or special processes, then drying to transform cherry to parchment;

- Cupping and grading the coffee to ascertain its quality and price;

- Finding a buyer for the coffee;

- Dry milling to transform parchment to green coffee;

- Bagging the coffee;

- Paying taxes, preparing export documents, transporting the coffee to the port.

Investment + Risk = Price Paid

Who performs each of these steps is different from origin to origin. Prices paid to each player in the value chain depend on the risk and investment they have made. The higher the investment and the greater the risk they carry, the higher the price paid for the coffee.

Cultivation and harvesting

Cultivating coffee requires an investment in land and trees, and the time and labour to tend to the trees and soil. Harvesting requires an investment in time, and sometimes in additional labour to ensure the coffee is picked when it is ripe. Coffee farming carries the risk of inclement weather, disease and pest impacting flowering, fruit production, drying and therefore quality.

Processing and drying

Processing the coffee requires investment in land, infrastructure and time. It carries the risk that the coffee spoils during this process, meaning quality and therefore money could be lost.

Cupping, grading, buying and storing

Cupping, grading, buying and storing the coffee requires an investment in staff, lab facilities and a warehouse space. It carries the risk of the coffee spoiling, meaning quality and therefore money could be lost. There is also a risk that the coffee purchased isn’t sold in a short period of time.

Milling, bagging and transporting

Milling and preparing coffee for export requires investment in a dry mill, or funds to pay for third party dry milling. It requires investment in staff and time to prepare the export documentation and cover the cost of transport and taxes. It carries the risk of the coffee spoiling, meaning quality and therefore money could be lost.

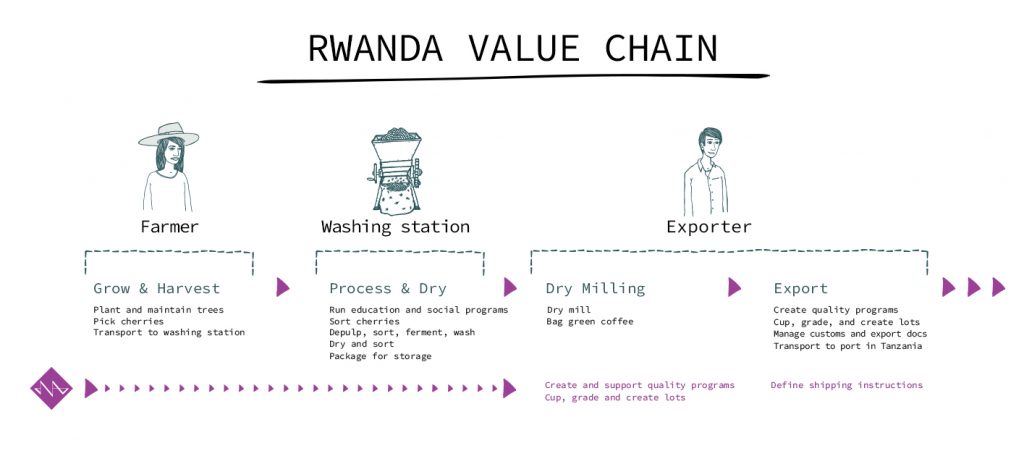

The Rwandan value chain

In Rwanda farmers generally deliver cherry to washing stations who process and transform it to parchment. Export companies purchase parchment from the washing stations. The “Farm Gate” price in Rwanda is paid for cherries and is therefore lower than the “Farm Gate” price in countries where farmers invest in processing and drying, and deliver parchment or green coffee.

Farmers

Farmers in Rwanda are typically smallholders with around half a hectare of farmland or less. They manage their farms with help from family members who care for the trees and pick the cherries themselves. Usually subsistence crops take up the greater part of their land, and coffee is a secondary crop. They deliver and sell cherry to washing stations.

Washing Stations

Washing stations are usually privately owned businesses buying cherry from smallholder farmers in their community. They process and dry the coffee, maintain traceability, usually separating the lots by local communities and hillsides. Washing stations make the investment in processing facilities and drying beds, plus labour and time, and carry the risk of the coffee spoiling during processing or storage.

Exporters

Exporters cup and grade coffee, and purchase parchment from the washing stations. Once a coffee has been contracted, these companies arrange for dry milling of the coffee, bagging, storage, transport to port along with export documentation. They also pay the relevant taxes to export the coffee.

Transport costs are higher for Rwandan coffees as the country is landlocked. The coffee must first be transported to the port of Dar es Salaam in Tanzania before it can be shipped. This cost is borne by the exporter and included in the FOB.

Exporters invest in cupping and grading facilities, dry mills and warehouses. They carry the risk that the coffee is spoiled or damaged during milling or transporting to the port, and the risk of not finding a buyer for the coffee they purchase.

In the case of our value chain in Rwanda, RTC pre-finance the washing stations, which means they carry the risk from the moment the cherries are delivered to the washing station, until the green coffee is loaded on the ship.

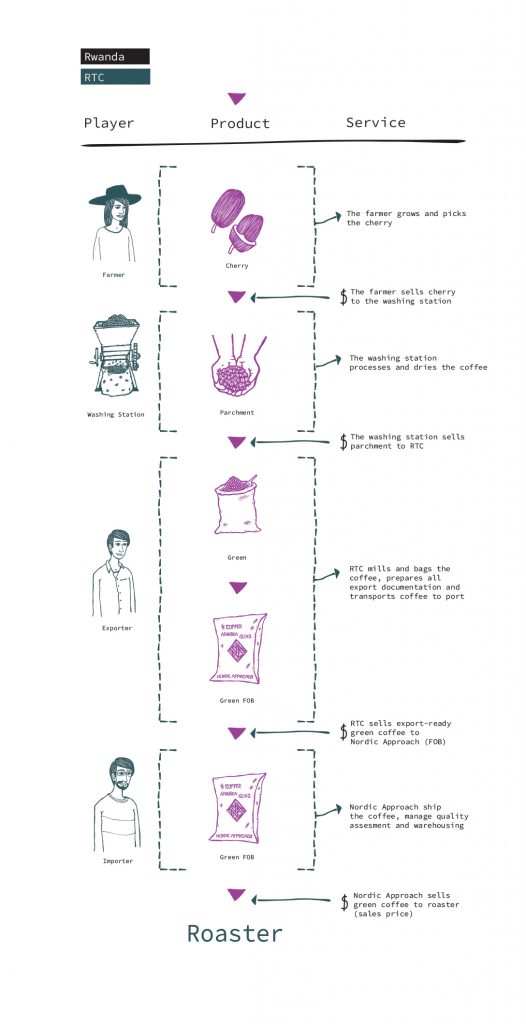

Our value chain in Rwanda

What you need to know about the price data

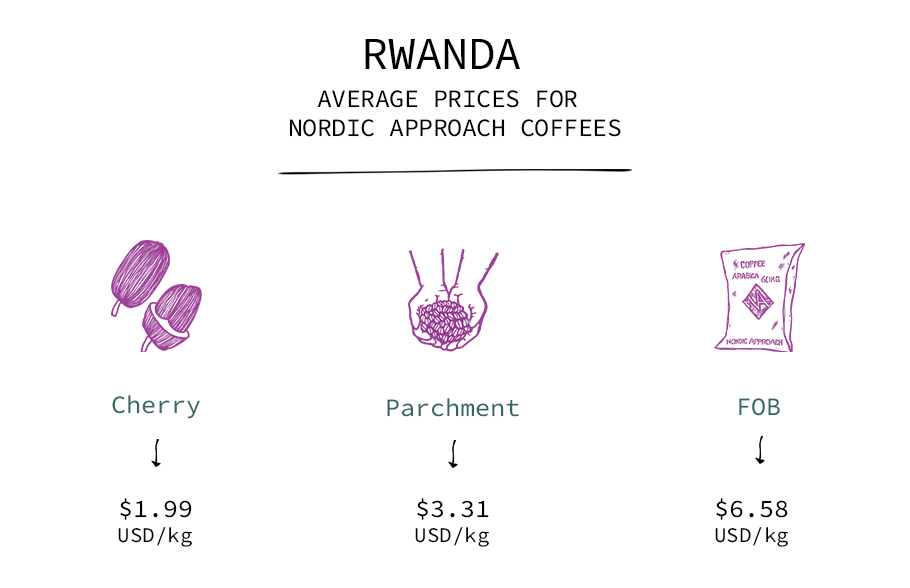

Below are the average prices paid across all Nordic Approach coffees purchased between September 2018 and September 2019.

The numbers displayed as paid to the farmers for cherry is converted based on the following assumptions:

- Cherry is bought in the local currency, Rwandan Francs (RWF). As cherry purchase happens over several months, the currency exchange rate is an average.

- Based on data from RTC we are using 7:1 ratio to calculate the price equal to exportable greens. That means you need 7 kg of cherry to produce 1 kg of green specialty coffee.

- Daily prices and market prices can fluctuate based on local conditions and the quality of cherry. We base the price on average.

- We like to keep the numbers conservative. Washing station owners have premium programs which distribute quality premiums paid for the green coffee back to the smallholder farmers as a second payment, but as we don’t have verifiable data on how these second payments are distributed amongst farmers, we have not included them in the cherry price. We do have data on the second payment paid to Mahembe Washing Station by RTC. See details below.

The National Agricultural Export Development Board of Rwanda (NAEB) set a minimum price for coffee cherries. In 2018 this was 240 Rwandan Francs (RWF) per kg. Unfortunately that price was very high compared to prices that exporters could earn on the international market, and many washing stations and exporters went out of business in this period, as they were unable to cover costs of processing, milling and exporting. In 2019 NAEB changed the minimum price to 190 Rwandan Francs (RWF) per kilogram of cherries to reflect the drop in the international market price. Washing stations adjusted their prices accordingly. This meant less money to the farmer, but a price that allowed washing stations and exporters to cover the cost of transforming cherries to exportable greens and transporting it to port.

In good years there is stiff competition for cherry. After NAEB sets the price, the washing stations compete with each other to attract farmers to deliver their facility, sometimes driving the price up. If a certain washing station has a market, like Gitesi and Mahembe, they are strongly discouraged from offering more than 10-20 RWF above the minimum price, in order to not distort the market. Instead they can pay second payments later when the coffee has been sold at a premium. They also offer other benefits like farmer training, and Gitesi’s successful cow distribution project.

While the price paid for cherries has fluctuated, we have kept our FOB price stable. When RTC find a buyer who is willing to pay a premium, they pay more to the washing station, who in turn make a second payment to the farmers.

Rwandan coffee prices by washing station

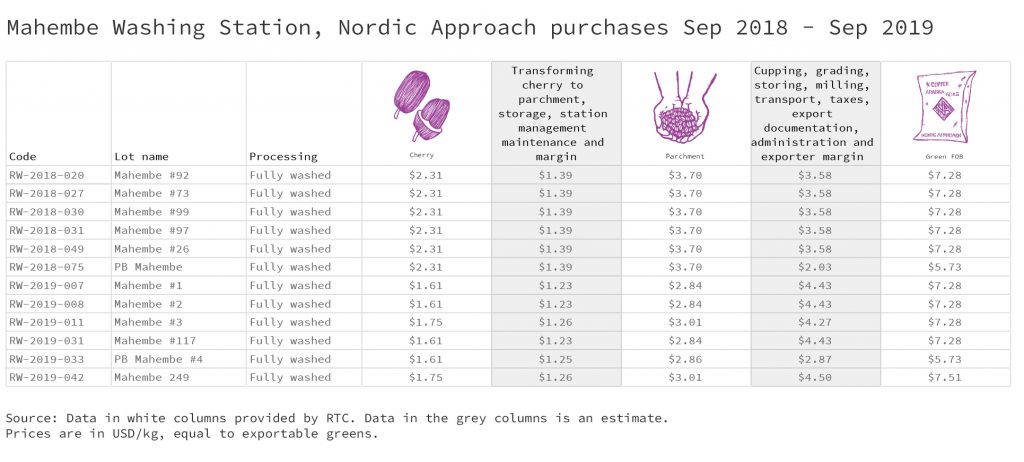

Mahembe

The owner of Mahembe, Justin Musabyiama, is also a farmer. He has an 8-hectare farm, plus he buys cherries from the surrounding smallholders.

Justin offers an agricultural extension program run by RTC to support the smallholders who deliver to Mahembe Washing Station. An agronomist helps the farmers manage their crops to increase both quality and yield so they can earn a higher income. We are so impressed with the work his team put in and the extremely knowledgeable staff at both the washing station and his own farm. The results are in the cup. You can check out a farmer profile here. https://nordicapproach.no/2019/05/rebuilding-rwanda/

A bonus to farmers is paid at the end of each season based on the premiums they earn when the coffee is sold to an international buyer. We do not have verified data on how this second payment is distributed to farmers so we have not included it in our cherry price. However we can report the amounts paid as second payments are as follows:

Mahembe second payments:

2017: $13,869

2018: $12,964

2019: $4,441 which is $1,441 Cafe Practices Certification Bonus and $3,000 Second Payment

Click image to enlarge.

Source: Data in white columns provided by RTC. Data in the grey columns is an estimate.

Prices are in USD/kg, equal to exportable greens.

Gitesi

Owners of the Gitesi Washing Station, Aime and Alexis Gahizi, are also farmers. They offer different programs for the smallholders who deliver to their washing station and their communities, including:

- A coffee nursery distributing free trees to coffee farmers;

- Distribution of pumps and other farming materials;

- Distribution of cows to local farmers to provide an alternative income stream, and a source of organic fertiliser. The first born calf to each of these cows is then given to another farmer. This helps to distribute more cows to more farmers and unifies the farming community.

- Health insurance for 100 of the poorest coffee farmers every year.

- Training for farmers on farm management, financial literacy and civic responsibility.

- Production of organic and chemical fertiliser, and training for farmers using it in their coffee farms;

- Sustainability programs

Gitesi are CAFÉ Practices and Rainforest Alliance certified. They have a modern waste water management system and produce natural fertiliser through coffee pulp. They also have a pilot programme where farmers can learn about growing different vegetables, ensuring that they have some income outside of coffee season.

A bonus to farmers is paid at the end of each season based on the premiums they earn when the coffee is sold to an international buyer. We do not have verified data on this second payment so we have not included it in our report.

Click image to enlarge.

Source: Data in white columns provided by RTC. Data in the grey columns is an estimate.

Prices are in USD/kg, equal to exportable greens.

Peaberries and blends

We have been seeking ways to deliver higher prices to farmers in Rwanda, and deliver coffees to the market at a more accessible price point. Our strategy is to buy peaberry lots. Historically peaberries are considered defects so they are removed during storing and sold on the local market for very low prices. We have discovered these coffees have a distinct flavour that can be equal in quality to our other lots. Rather than let the coffee be sold for less than it is worth, we keep these lots separate and buy them at a premium.

Click image to enlarge.

Source: Data in white columns provided by RTC. Data in the grey columns is an estimate.

Prices are in USD/kg, equal to exportable greens.

Transparency at Nordic Approach

This was our first origin transparency overview. You can read our other overviews here.

It was a small step, the start in our ongoing commitment to display price transparency data from origin and the culmination of countless hours of discussion and thought on the best way to present this data from origin.

Morten, Jamie and Suzie share their thoughts on our first origin report.