Our sourcing strategy

Brazil has become one of the origins I am most excited about. It is a coffee producing country that is misunderstood, and where we accept the most common forms of production as the rule without exception. We focus on creating a stable market for the producers we buy from, working with them to capture their volumes of normal coffee as well as giving them an avenue through which they can make better margins through additional or specially prepared coffees. We buy natural coffees, and other process driven coffees that are fully traceable.

The cup profiles

We want to show our customers what Brazilian coffees can be when producers make enough to be able to invest in production, so big funky fruit and some wildly expressive Naturals. As well as solid milk chocolate and sweet coffees.

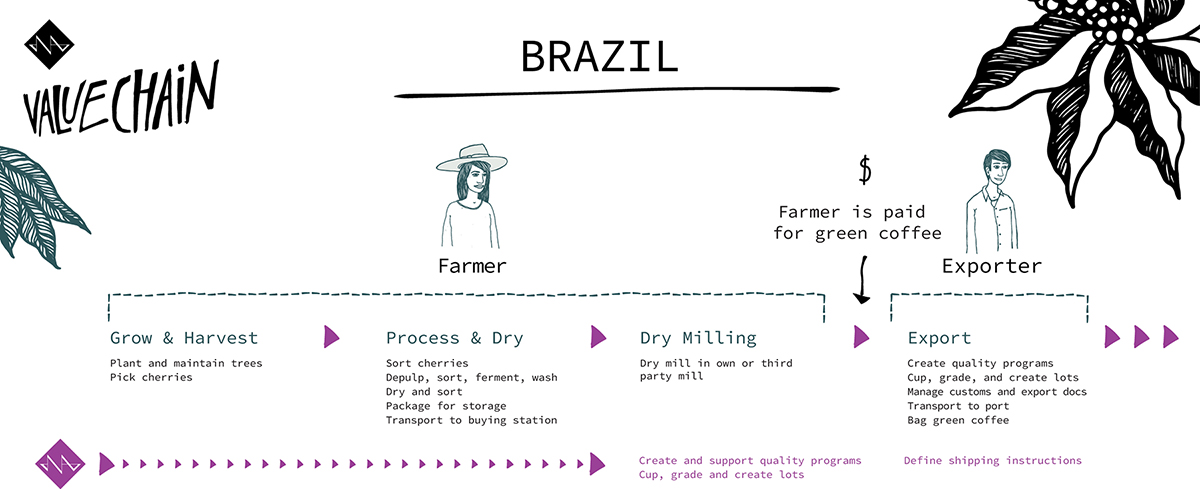

The value chain

There is no typical coffee farmer in Brazil. Brazil is known for huge farms that are mechanical picking and drying coffees, and that are run very well as businesses. There are also many small to medium size producers. Farmers typically process coffee to green stage something that is called bica corrida in Brazil. At this stage the coffee is not sorted or clean and samples are offered to exporters or deliver to a cooperative. Exporters cup and classify the coffee giving producers feedback. The exporter will then clean and sort the coffee, and export green coffee.

The relationships

Brazil is a producing market that is so closely tied to the C-market. This leaves producers vulnerable and carrying a lot of risk, and creates a necessity to take advantage of opportunities to maximise income where possible. This has an impact on the relationship between buyer and seller.Generally producers will offer their coffees to many different exporters and sell when they need cash quickly, or to the highest bidder. We have spent the last 3 or 4 years going back to the same producers or groups of producers, asking for their coffees and buying the coffees that meet our required qualities. We have also been sharing the knowledge we have about processing and what our market values in the cup. In this way we have developed relationships where producers are offering us their coffees and giving us priority. Jaguara is the farm in Brazil that we have a commitment to, we have been working with Natalia and Andre since we started to focus on developing our Brazil buying in 2015. They have been crucial partners in our Brazilian buying, not just because we focus on coffee from their farm but also because they have helped connect us to other growers. There are other crucial farms and producer’s that we have built long term relationships with, Augusto’s farm Capadocia, we have been working with since 2016. Augusto has also helped connect us with the other producers of his family, his wife’s uncle also has a coffee farm, he has also helped to encourage farmers in his community to focus on producing quality coffees.

The challenges

Brazil is known for producing stable, consistent coffees with a certain profile; milk chocolate and nutty that are cheap. This is a profile that most roasters are only willing to pay a certain price for, and intern this price for a producer limits their ability to create a different, a better coffee. Brazilian coffees can be something different than what we have become accustomed to expect if we are willing to pay for what it costs to produce them.

Producers have to manage their production to minimize costs, as the costs of production in Brazil are high relative to what the market will pay for these coffees. This means that unless there is a secure market for a more expensive coffee a producer cannot invest in quality.

Background info

Brazil ‘s claim to fame is being the world’s biggest producer of coffee. The production is spread across 12 states and 6 differentiated producing regions, we are buying coffees from the Minas Gerais region which is responsible for 50% of the countries production.

History has coffee entering Brazil in the 1700s and production spreading from the North to the Southeastern mountainous states and thriving here because of the temperature, heavy rainfall and distinctive dry season. Similarly the abolishment of slavery in 19th century lead to an influx of millions of immigrants from all over the world and who provided a ready and able work force for cultivation.

The focus of Brazil’s production is volume and cost management.

The Cultivars

There is a lot of research into different varieties from national universities and institutes within Brazil, they are advising which varieties are best suited to each growing region. The purpose is to improve yield, quality and resilience to diseases, and new varieties are being developed. Most producers are growing a number of varieties, and are separating their farms by section where they grow specific varieties. The most commonly seen varieties in Brazil are Mundo Novo, Acai, Red Catuai, Yellow Obata, Red Obata, Topazio, Yellow Icatu, Red Icatu, Catucai, Red and Yellow Caturra, Yellow Bourbon, Red Bourbon, Arara.

Planting and production

Coffee is grown and agronomically managed in different ways depending on the kind of producer, size and intention to produce quality. There is a lot of access to knowledge on agronomy for Brazilian producers, sometimes this is valuable and sometimes it is misguided.

If producers want to improve their production they have access to the tools to do so, the biggest limitation being the availability of finances to invest.

Picking and selection

Cost of production in Brazil has risen substantially in the last years, due to general cost of living increases. Labour being one of the most costly parts of producing coffees, while on flat or larger farms mechanical picking is a viable option. For smaller or farms situated on hilly terrain this is not possible and farmers have to optimize capturing as much of the harvest as possible with limited resources for picking. It is common in Brazil to see cherry of all sorts and colours in the coffee picked and drying, the common belief in the industry internally is that this will be sorted out through the milling process. The reality is, that it is just too expensive to pick only ripe cherries for the prices that Brazilian coffees are sold at in the market.We are working with producers to do some lots with selective picking, and while we undoubtedly see a difference in the cup the producers report a difference in cost of 3 times that of standard picking procedures.

Processing

We are focussed on Natural coffees, and additional experimental preparations. Brazil is processing coffees as washed, pulped natural and natural, with the majority of the volumes being natural.

Historically in Brazil the flowering has been very uniform and this has allowed Brazilian producers to pick mechanically or to pick everything in one go and better manage the costs of picking. In recent years the change in climate and the variations from year to year have been making this more difficult, and means that there is more unripe and overripe cherries mixed in with the ripe fruit. The belief in Brazil is that these coffees are cleaned up in the after production processing, in the mill.

This is a challenge though because we see the effect this has on quality.

Drying

Drying in Brazil is almost entirely done on concrete patios, in some cases where a producer has a very simple set up, Natural coffees can even be found to be being dried directly on the ground. We are working with some producers who use both patio and raised African beds, and this isa well discussed topic among us.

In Minas Gerais at the time when a lot of the coffees are drying the daytime temperature can reach highs of around 25 degrees celsius, but both in the evening and morning it can be very cold. Some of our partners argue that while the raised beds allow for aeration the patios absorb the heat from the day and carry this into the cold temperatures of the night and early morning not allowing the coffee to drop in temperature to the same extent as the raised African beds. We have not done any experiments, nor had any experience to confirm or deny such a claim!

At a glance

Harvesting season: May – October

Arrival times: October – January

Quantities: Varies from 5 – 100 bag lots. Average 30 bag lots

Packaging: 60 kg grainpro bags

Price levels: 8,95 – 12.50 USD/kg, average around 9,45 USD/kg

Cultivars: A diverse range of cultivars being grown, and constant development is taking place. We most commonly see Catuaí, Mundo Novo, Icatu, Obatã, Catuaí and more recently Acaia

Processes: Mostly Naturals, can find Pulped Naturals too. Sundried on patio and african beds in sun

Flavor profiles: Milk chocolate, cocoa, hazelnuts, red fruit, and funk

Usage: Widely used for espresso either single origin or in espresso blends, can also be used for filter

Shelf life: Normally holds up well for 9 months to a year. We can never guarantee more than 6 months after arrival for any coffees

Brazil Videos:

Brazil Blog Posts:

A conversation with Joanne Berry: digging deep into Brazil

As we gear up for our first Brazil shipments expected to arrive next month, we had a chat with Joanne Berry, Head of Procurement & Sourcing at Tropiq. Joanne has played a fundamental role in our sourcing strategy in Brazil, present since the very beginning. She has been travelling to […]

How C Price volatility impacts coffee

You may have noticed a sharp increase in the C-market lately. The current situation in the coffee futures market is not unfamiliar to most of us who have been in the industry for some years. The implications beyond the current cost of coffee can be given less immediate thought but […]

How to plan your buying for Jul – Dec 2021

If you only have 30 seconds, read this: For the second half of the year we will have coffees from Colombia, Brazil, Peru, Uganda, Rwanda, and Indonesia. Samples will start arriving in July/August, and coffees will land from Sept/Oct onwards. Coffees will be slightly more expensive in the coming months, […]