Our sourcing strategy

There is so much great coffee in Colombia, and it can be tempting to make selections based on the top scoring coffees each harvest, skim the cream, so to speak. This is not our approach, rather we seek to develop ongoing relationships with private producer groups, cooperatives and exporters, and build quality programs into our buying. We often refer to these programs as “projects” or “concepts”.

As most producers in Colombia are smallholders managing their farms and processing their own coffee, our concepts focus on both micro-lots and larger blends. The purpose of the blends is to give smaller volume producers access to the specialty market by creating bigger volume lots that match in profile, region or mission. These coffees are sourced from Huila, Tolima, and Nariño.

Additionally we work with a single producer in Antioquia, Juan Saldarriaga. Juan is a pioneer in specialty in Antioquia, and a leader in his community of coffee growers, sharing knowledge and providing resources to bring more producers into the specialty market.

The concepts

Recolectores

This coffee is made up of contributions from a group of different farmers in the Yacuanquer area of Nariño. These farmers are part of a group who work collectively during the harvest. With help from the local cooperative, they have been trained to only select the very best cherry. In return we pay a premium for their coffee that covers the additional costs of selective picking.

Madremonte

This is a coffee from female producers in Huila who earn a premium for delivering quality coffees. The program is run by our partner of many years now, Coocentral. This programme gives us the chance to acknowledge the women who play a major role in coffee production throughout Colombia.

El Divino Niño

El Divino Niño is our name for the crafted micro blends we have from the department of Huila. The farmers in Huila are small, and the deliveries of coffees can be tiny from each individual producer. In the case where there is enough volume to make a microlot of 5 bags or more, we keep them separated as single producer lot and sell them by the name of the producers. When the deliveries are smaller, we normally mix coffees from producers and flavor profiles that match up, and call the lots El Divino Niño, divided by different lot numbers.

Juan Saldarriaga

Juan Saldarriaga is a producer, not a concept, but he is the driving force behind our Antioquia selection. Juan took over his family’s farms in 2012 with a mission to transition to specialty coffee. He planted new cultivars and invested heavily in processing infrastructure to develop new and sought-after profiles. Juan is a specialty evangelist and responsible for bringing more young producers into the specialty market, proving that Antioquia can produce more than heavy-bodied chocolatey profiles.

Bomba de Fruta

It is not common to find coffees being produced as naturals in Colombia. However, we have been buying some natural coffees from an individual producer in Antioquia. Bomba de Fruta is a concept we created to refer to these natural lots, which literally means “fruit bomb” in Spanish. With a better understanding and knowledge of fermentation, and with ways of controlling this, we started to discuss processing coffees with producers. This allowed us to find different ways to achieve more fruit and still great coffee.

Fruta Madura

Fruta Madura means ripe fruit, and is the concept name we have given to these ‘washed’ coffees where the cherries are left for an extended fermentation before they are pulped, washed and dried. We partner with some of our producers to create these lots in order to get even more of the fruit characteristics out of the coffee.

The challenge

There is so much great coffee grown in Colombia, the challenge is ensuring these micro lots and distinct smaller blends find their way to roasters.

Colombia is an enormously diverse country with many micro-climates and soil conditions ideal for growing and processing exceptional coffee. However, the majority of coffee farmers in Colombia are smallholders with limited resources and limited access to the specialty market. The National Federation of Coffee Growers (FNC) has a purchase guarantee program with buying stations set up all over the country, meaning farmers can sell their coffee any day of the year to the FNC, for a price that is widely published. This is a great safety net for farmers, but it can also see exceptional coffees disappear into larger regional blends.

We work with producer groups, cooperatives and specialty focused exporters to create ongoing buying programs to ensure these great coffees remain distinct and traceable to the producer or producer group. These programs, which we call “projects” or “concepts” always include a quality program to teach farmers how to consistently producer high quality coffee and access the quality premiums we pay.

Challenges in production and harvesting

Finding pickers is a constant challenge that has only been made worse by the Covid-19 pandemic.

Climate is always a challenge. In Huila it can potentially rain non-stop for weeks during harvesting, fermenting and drying. In Nariño it can be the opposite, with high temperatures and droughts. This will again affect maturation, fermentation and drying. The growing conditions and practices can often compensate for that, and the outcome can be absolutely amazing.

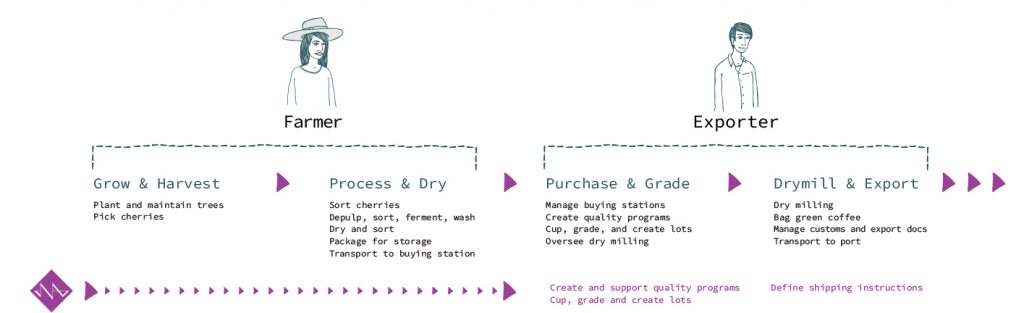

The Colombian value chain

Farmers are typically smallholders with around 2-5 hectares of farmland. Coffees are usually processed at small micro mills on the farm. Farmers deliver parchment to exporters or cooperatives who cup and grade the coffee, dry mill and export green coffee. This is the predominant value chain for the coffees we purchase in Colombia.

The cultivars

In Colombia, Caturra is generally known for having the best flavour attributes. We agree, if the farmers do everything right at each stage in the production cycle. That said, we see a lot of amazing cups with the Colombia and Castillo varieties as well. If they are well treated by the producer, and picked when they are extremely ripe, meaning a very deep red to purple colour, they lose the common herbal and astringent flavours associated with these varieties, and become super sweet and complex. Most farmers will have a mix of 1-3 of these cultivars which helps maintain diversity and mitigate the risk of disease and infestation.

Background info

There are more than 500.000 coffee producers in Colombia, 80% or more are having less than 3 hectares. Coffee is grown all over the country and is spread out in 19 departments (regions), most of them along the three mountain ranges coming from the Andes in the south. The biggest and most well-known regions are Antioquia, Huila, Tolima, Cauca, Nariño, Caldas, Santander and Sierra Nevada. The latitudes are ranging from 2 degrees to about 12 degrees. Altitudes for coffee production can vary from 1200 – 2200 meters above sea level. All producers are picking, pulping, fermenting and drying their coffee themselves in their “micro beneficios”. The coffee is then sold in parchment and delivered a local town to a bodega. The bodega is a purchasing point for parchment and can be represented by a growers association, a cooperative, an exporter, or just an independent local middleman. There’s always someone buying random coffee, while some others have quality programs or strong relations with the producers.

Harvest and processing

Picking & selection

Coffees are picked in three to four passes, meaning the producers and pickers pick the ripe cherries in one block, then wait until there the remaining cherries begin ripening before doing another pass. It can be hard to incentivise your workers to only pick the ripe cherries as their payments are usually based on volume, and the work is harder. Even when you’re paying them extra for the effort, it can be hard to changed entrenched mindsets. If a producer wants exceptional qualities they often have to follow up very closely, or hand sort the cherries after picking, before they begin processing. Generally the first and last passes produce lower quality, and the second and third will be considered as the best, with more ripe cherries and uniform quality. When we can, we try to buy parchment harvested in these the second and third passes.

Dry fermentation

This is the most common and widely used method. The farmer will have a small beneficio, a small manual or electric pulper and a fermentation tank. They pulp the cherries in the afternoon and send the beans directly from the pulper to the fermentation tank. The coffee can sit there from one to two days, depending on the temperature. Higher temperatures will speed up the fermentation process, and lower temperature will slow it down. Some producers do intermediate rinsing with water, which can also help them control the process.

Wet fermentation

Some producers use the wet fermentation method, meaning they add water to the tank after pulping. Some of the best coffees we have tasted in Colombia have been fermented this way. They often change the water numerous times, which will both slow down the fermentation time and provide a bigger window between properly fermented and over fermented. It also helps uniformity as producers can skim off the floaters during the rinse and get a better selection.

Washing and grading

Methods for washing and grading vary widely. Some producers have channels, some don’t. The channels are often short, and they don’t require huge amount of water. Producers normally stir the coffee in the channels before they remove floaters. Producers without channels commonly wash the coffees in the fermentation tank and skim off the floaters before sending the coffee to the drying table.

Drying

Smallholders in regions like Huila, Tolima, Nariño usually sun-dry their coffees on roof tops or in parabolic dryers that almost work as green houses. There are many different variations and construction types, but generally they are all systems that protect the coffee from rain. In many places it can either be too hot, or too rainy and humid, often both in one day. We generally see consistently great coffees from producers who have drying systems with good ventilation that allow them to reduce the humidity of the coffee to less than 11% between 10 to 18 days.

In other places like Antioquia and Quindio mechanical dryers are commonly used. We generally don’t buy coffees dried mechanically as we so far don’t have very good experience with the flavor and shelf life related to that process.

Parchment delivery

Coffee in Colombia is a cash crop, meaning you can sell your coffees any day in big or small volumes and get direct payment in cash. Every small town in the coffee growing areas will have purchasing points for parchment, called bodegas. These can be run by local traders who resell to exporters, exporters themselves, growers associations, cooperatives or the FNC. In many cases they are located in the same place and compete to get the coffees from the growers. Most parchment buyers will assess the quality simply by looking at the physical attributes, and pay the producers based on the yield factor. (For more about yield factor, read this blog post on the Tropiq blog.) They do not care about the individual flavour attributes and generally add the recently purchased coffee to the pile. Coffees from all the different producers get mixed and sold as a general “excelso” quality coffee from that region. There are exceptions, and these are the local buyers we work with.

We work with groups, exporters or cooperatives who have their own bodegas where they purchase parchment from producers that are part of the our programs. Our selected farmers often deliver very small volumes at the time, and the coffees that meet the target moisture levels, yield factor, and quality will be kept separate and cupped individually. If they score at a higher level by the local cuppers and by us, they will be approved for purchase.

At a glance:

Harvest:

Antioquia: Main Oct-Jan, Mitaca Apr-Jun

Central Huila: Jun-Nov

Sourthern Huila: Sep-Jan

Nariño:May-Sep

Arrival times: December – February and September – November

Quantities: 3 – 100 bag lots. Average lot size is around 10 bags. We offer exceptional micro-lots plus we curate 50-100 bag blends at moderate pricing.

Packaging: 24-30 kg vacuum boxes and 70 kg grain pro bags

Price levels: 9 – 14 USD/kg

Cultivars: Mostly Caturra, Castillo, and Variedad Colombia, but also Tabi, Bourbon, and Typica.

Processes: Mostly washed but we are working with producers to produce some naturals and honeys.

Flavour profiles: Generally very complex, rich and fruit-driven with attributes like florals, berries, mature plum and grapes, blackberry, currants, stone fruit and citrus.

Usage: Can be used for everything from complex filter brews to rich, sweet and creamy espressos.

Shelf life: Should hold up well for 9 months, and can often be more. Our coffees in vacuum can be great for over a year. Still, we can never guarantee more than 6 months after arrival for any coffees.

Colombia Videos

Colombia Blog Posts

Meet our newest supplier in Colombia: Cuatro Vientos

Maximising an origin’s potential is always on our list of priorities as we continuously search for innovation and new ways to diversify our product portfolio. In Colombia, our approach revolves around developing in-depth relationships with private producer groups, cooperatives or exporters. We recently started working with a new supplier, Cuatro […]

Coffee Commercialization in Colombia

Coffee has been one of the main agricultural sources of income for Colombia, representing 35% of the agricultural GDP (Gross Domestic Product) in the country. To understand how coffee is commercialized, we’ll study the dynamics behind it, or to be more specific, how the money and the product move across […]

Colombia harvest update

It has been an exacting year in Colombia and for coffee producers across the country. The Colombian people have been grappling with changes in the climate of the country that have dramatic effects on agricultural products, and the coffee harvest has seen these effects.The internal market has seen the highest […]