How we work in this origin

Ethiopia is our largest origin in volume, and one of the most complicated. The country exports such large quantities of coffee within a system that is strictly regulated and ever changing. It’s not surprising that it is where we have invested the most resources.

There is so much good coffee grown in this part of the world, but finding it and maintaining that quality through every step of the process is enormously challenging, so this is where we focus on adding value for our roasters. Through our sister company, Tropiq, we have an office and lab in Addis Ababa, and a team on the ground. Their job is to shepherd your coffee through each step of the milling and shipping process. Throughout the season they visit washing stations and when coffees are being shipped, they are at the warehouses every day, taking samples directly and ensuring the fastest logistics possible.

Most importantly, our team in Ethiopia builds relationships with trusted suppliers who share our values of traceability, transparency, and supporting smallholder farmers. These relationships are crucial to securing the best quality coffee, but also impact on the wellbeing of the farmers who grow the cherry.

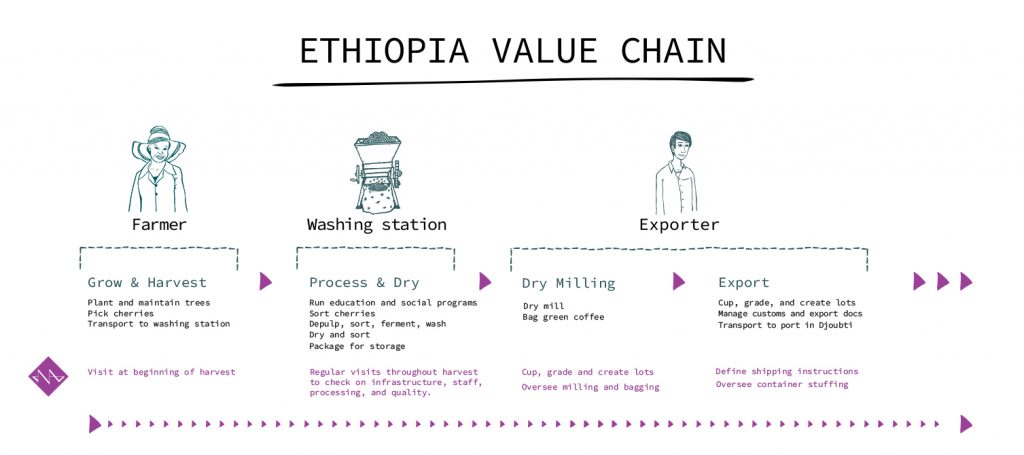

The Ethiopia value chain

Before digging into this financial data, it is essential to understand the value chain in Ethiopia. For an overview of coffee value chains, and how it provides context to farm gate prices, read our primer What You Need To Know About the Value Chain.

Ethiopian coffee farmers are typically smallholders with around one quarter to two hectares of land. Farmers grow and pick the cherries, then sell the cherries to a local washing station. These stations can be independent businesses, owned by a farmer cooperative, or vertically integrated with an exporter. The washing stations process the cherries and dry the coffee, to the parchment stage.

Exporters purchase parchment which they cup, grade and divide into lots to offer to green coffee buyers. When the coffee is purchased, they mill the coffee, prepare the export documentation, and transport the coffee to the port in Djibouti for shipping.

The changing role of the ECX

Coffee is a very important agricultural export for the Ethiopian economy, and has therefore been very tightly controlled by the government. Until very recently, all coffee traded in Ethiopia was bought and sold through the ECX. This entity inspected every lot of coffee, assigned it a grade according to its quality (Grade 1 being the best), and assigned it a regional profile such as Yirgacheffe or Guji. These regional profiles reflected the taste of the coffee, and not always its actual region. Additionally, the ECX did not share information regarding the washing station or community with buyers, so for many years it was impossible to offer fully traceable coffee in Ethiopia.

The coffee sector was liberalised in 2017, and the role of the ECX in the coffee trade was reduced. Currently the ECX still inspect and grade almost every lot of coffee that is traded, however it is now possible for exporters to track coffee from a washing station, through the ECX grading system, and on to port.

Additionally:

- Farmers have the right to hold an export license;

- Exporters are allowed to own washing stations;

- Exporters are allowed to export directly to a buyer;

- Experimental coffees are no longer regarded as defective coffees.

The Minimum Export Price

Part way through the season last year the Ethiopian government announced a new directive to set a minimum price for coffee. This is part of broad economic reforms intended to curb the practice of selling agricultural products on the international market at a loss in order to raise foreign currency.

Starting on February 28, 2020, the Coffee and Tea Authority, coordinating with the National Bank of Ethiopia, set a daily minimum export price for coffee . This price depends on a global weighted average price given to different grades of coffee from different regions. The directive is called the “Export Coffee Contract Administration”.

On average, this minimum export price has raised the overall price for green coffee by 0.5-1 USD/lb for Grade 1.

Our value chain in Ethiopia

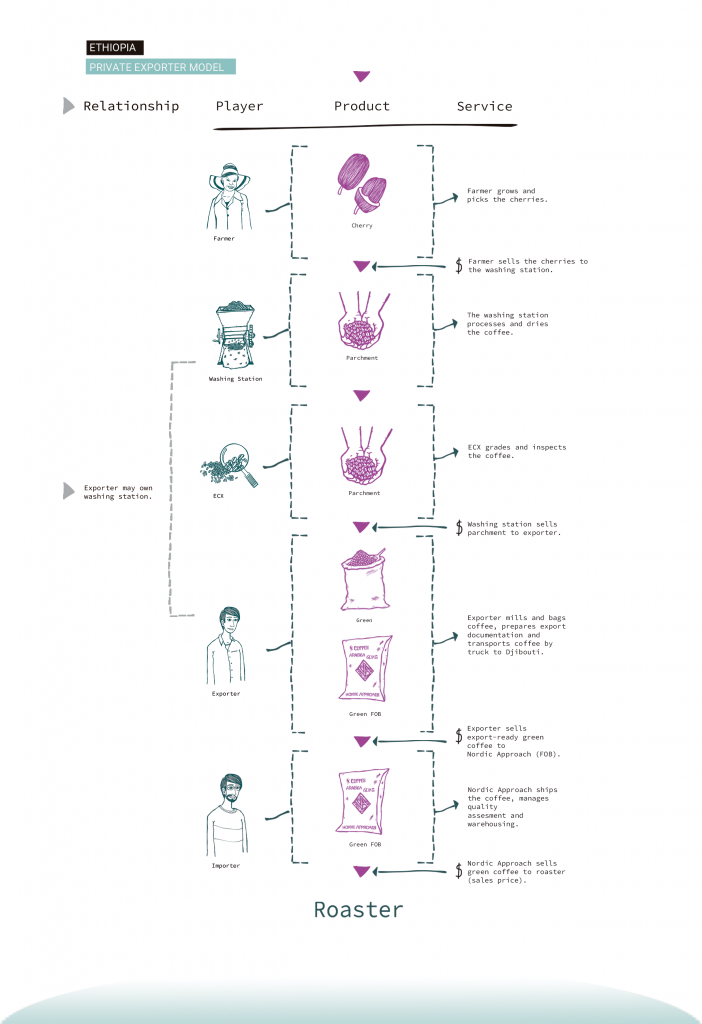

We work with various suppliers in Ethiopia who operate according to different value chains. We have divided these chains into three categories: Private Exporter, Representative, and Cooperative/Union.

Private Exporters

Private Exporters are companies who buy parchment from the washing stations. They find international buyers for these coffees, then manage warehousing, milling, bagging, export documentation and transport to Djibouti where it will be loaded on a ship.

Private Exporters we work with:

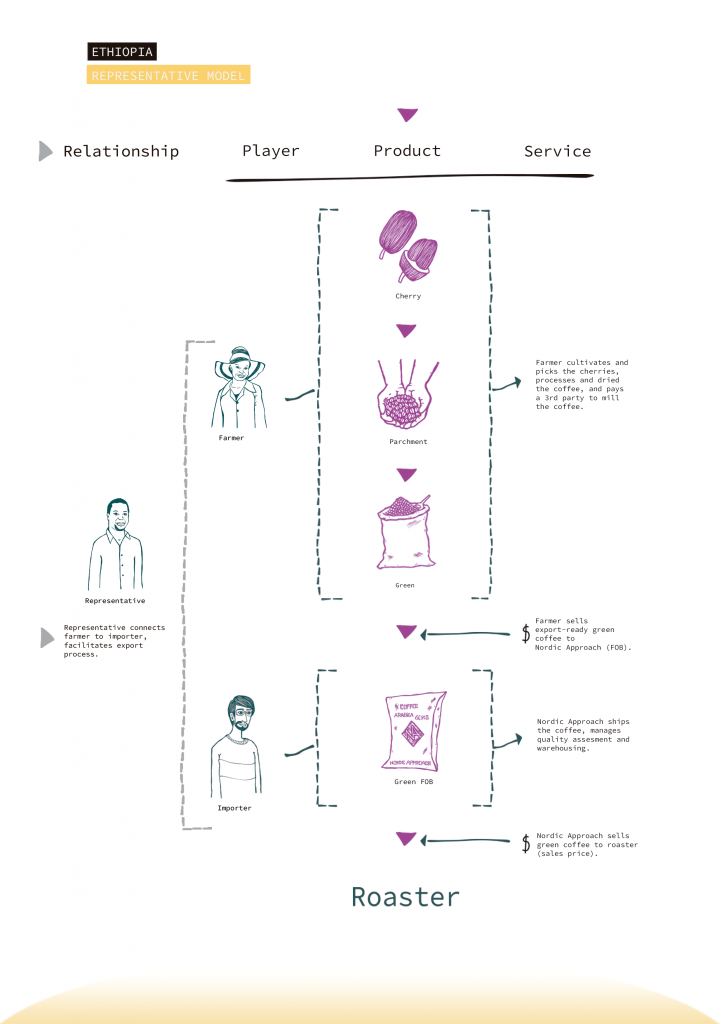

Representatives

Recently the regulations in Ethiopia changed to allow medium sized farmers to apply for an export license. Representatives are individuals or companies who work with coffee growers whose farms are large enough to apply for an export license. The representative assists these farmers with logistics, milling, export documentation, and help them find international buyers for their coffee.

Representatives we work with:

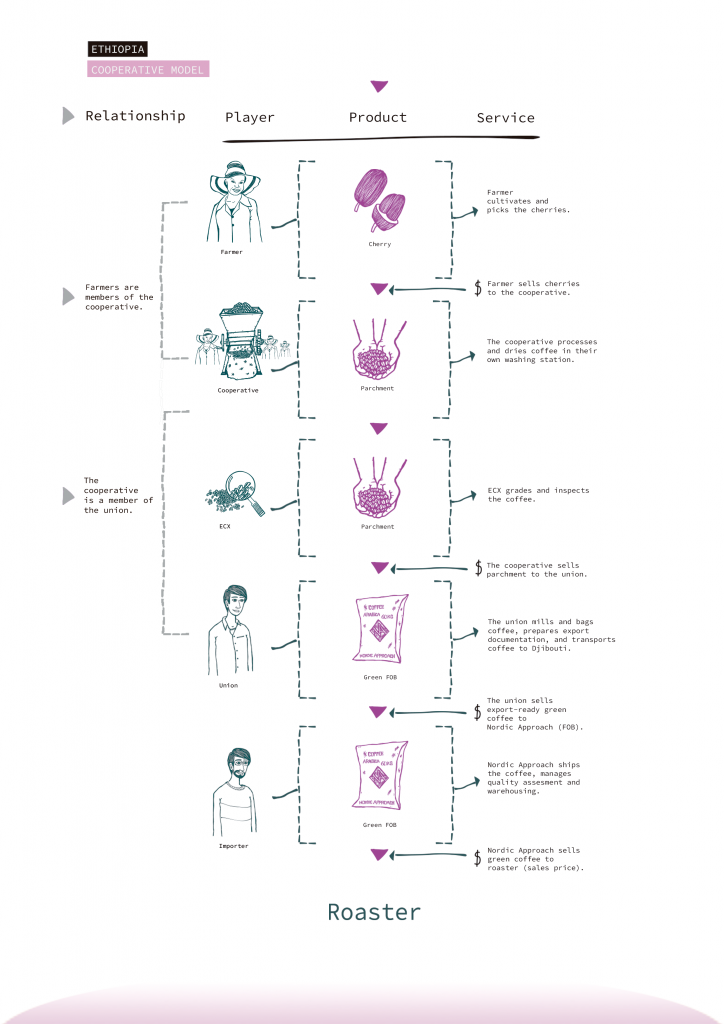

Cooperatives and Unions

Cooperatives are farmer-led organisations who own one or more washing stations. Cooperatives join Unions who act as the exporter for all their members.

Unions we work with:

What you need to know about this price data

Cherry prices:

Farmers deliver cherry to either collection points where washing stations and cherry contractors are represented, or directly to the nearest washing station.

The Ethiopian government sets a minimum regional cherry price at the beginning of the season. Within each region, washing stations compete for cherry by increasing the cherry price, depending on demand. Changes happen daily and depending on the size and importance of the buyer, it can have a vast regional effect on price.

There is usually good competition between washing stations in a given area so farmers can sell to whoever offers the best price. Cherry is bought by the kilogram and paid for in Ethiopian Birr (ETB).

Second payments to farmers, once coffee has been exported, are increasingly common in Ethiopia, and paid to farmers by our partners. We have not included these second payments in the price data in this report as they are difficult to verify.

Parchment prices:

Washing stations transform cherry to parchment which they sell to exporters. Many exporters also own washing stations. Parchment is bought by the “ferasula” which is equivalent to 17kg, and paid for in Ethiopian Birr (ETB).

Discovering the price paid to farmer:

As the cherry prices change daily, and farmers deliver small quantities of cherries every day over a series of months, it is currently impossible to discover the exact price paid for the cherries that end up in Nordic Approach coffees. Instead we are reporting the average prices paid for cherries in each region across the entire season, as reported by our partners. We have calculated a weighted average based on the volumes we purchased from each washing station.

Prices and costs for Nordic Approach coffees

Price data for all Ethiopian coffees purchased by Nordic Approach during the 2019/2020 harvest.

Average cherry prices ETB/kg in the 2019/2020 harvest

Reported by our suppliers.

| Region | Average cherry price 2019/20 |

| Guji | 27 |

| Jimma | 16 |

| Limu | 13 |

| Nensebo | 14 |

| Sidama | 25 |

| Yirgacheffe | 22 |

Our suppliers all report making second payments to farmers for coffee once it has been sold to an international buyer, to reflect the quality premiums earned. The second payments are around 2 – 3 ETB/kg of cherry. However, as we don’t have any documentation verifying these second payments, we have not included them in the chart above.

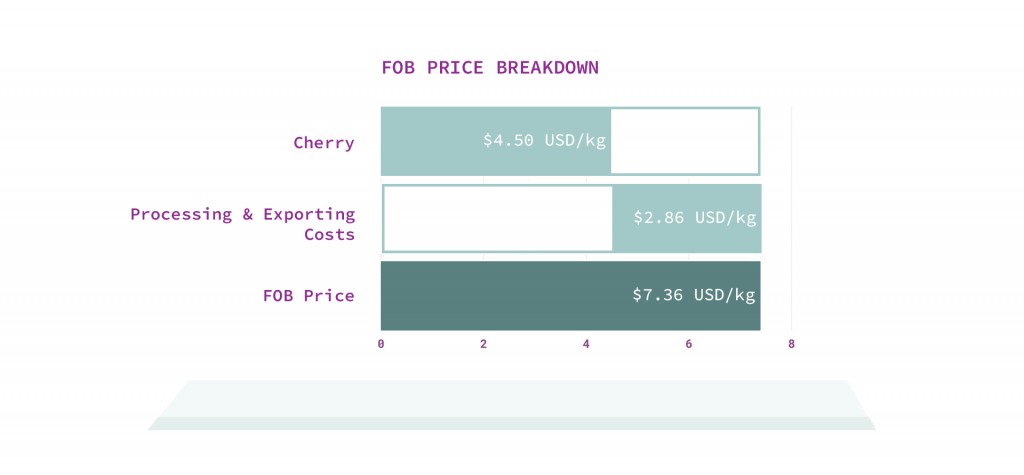

FOB breakdown

Based on the average prices and costs for coffees purchased by Nordic Approach in 2019/2020, equivalent to USD/kg exportable green.

Processing and export costs include:

- Cost of transforming cherry to parchment at washing station;

- Sorting out lower density coffee to increase the overall quality of the final lot;

- Washing station margin;

- Transport to Addis Ababa;

- Warehousing in Addis Ababa;

- Dry milling;

- Dry milling loss;

- Export document preparation;

- Transport to port;

- Local taxes;

- Exporter margins.

See how we calculated these costs and prices.

What do we mean by “equivalent to 1kg of green”?

At each stage of processing there is loss that reduces the weight of the coffee. These losses include the cherry skin, mucilage, water content and parchment, plus any defective cherries, beans or other contaminants removed during the sorting process.

To calculate the equivalent to green prices, we have used the following ratios which were reported by our suppliers:

Cherry to parchment 5:1

We need 5kg of cherries to produce 1kg of parchment.

Parchment to green yield factor 75%

We lose 25% of the weight in milling parchment to produce green coffee.

After factoring in these losses, we can calculate what the farmer earned for their cherry per kilogram of green coffee we sold.

See how we calculated these costs and prices.

Transparency at Nordic Approach

This is our third origin transparency overview. You can read our other reports here.

These origin overviews are a part of our ongoing commitment to display price transparency data from origin. They are the culmination of enormous effort from the Nordic Approach team to source accurate data from origin, plus countless hours of discussion and thought on the best way to present this data.

If you have thoughts on this report, or our transparency reporting in general, we would love to hear from you.